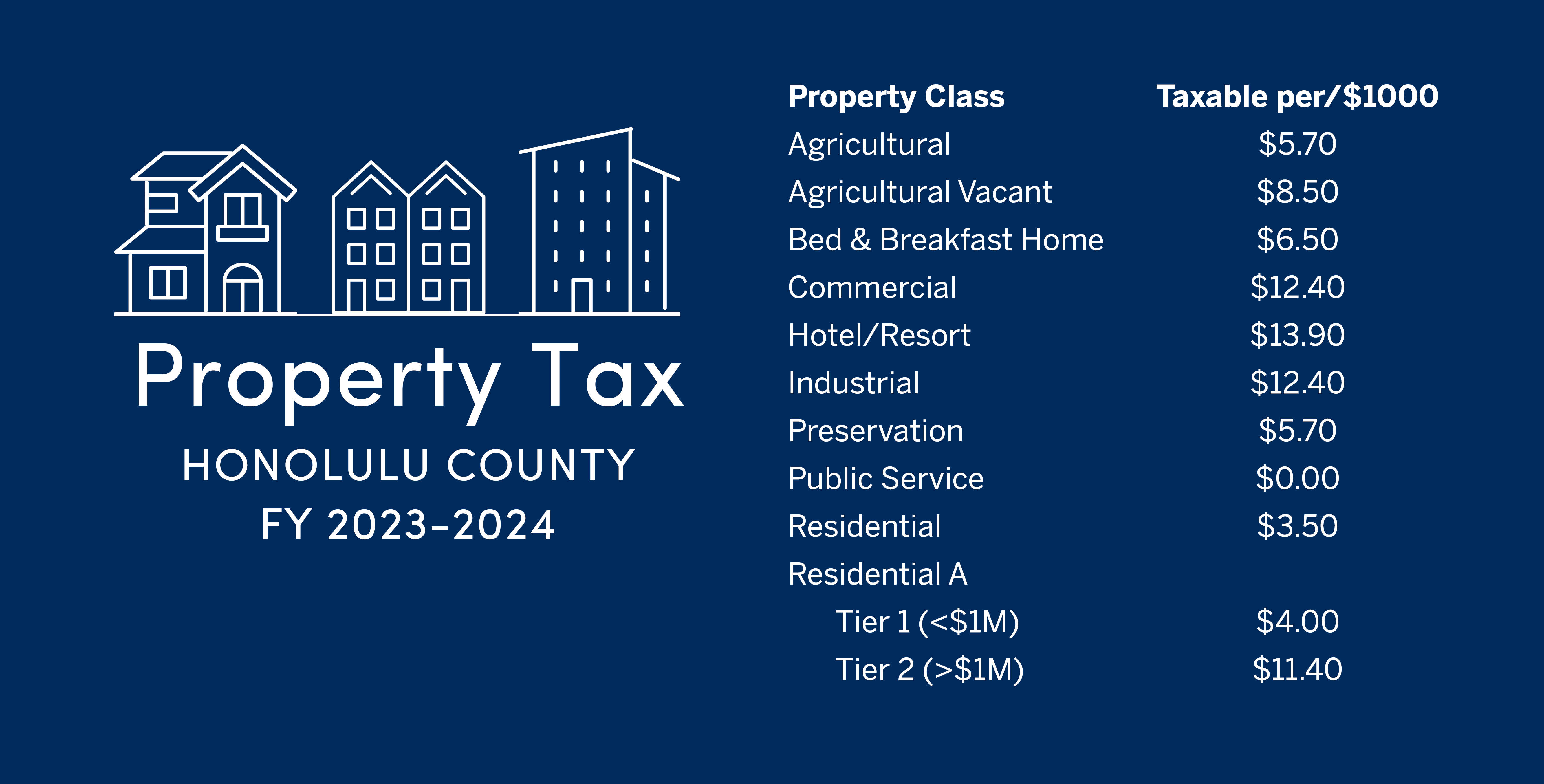

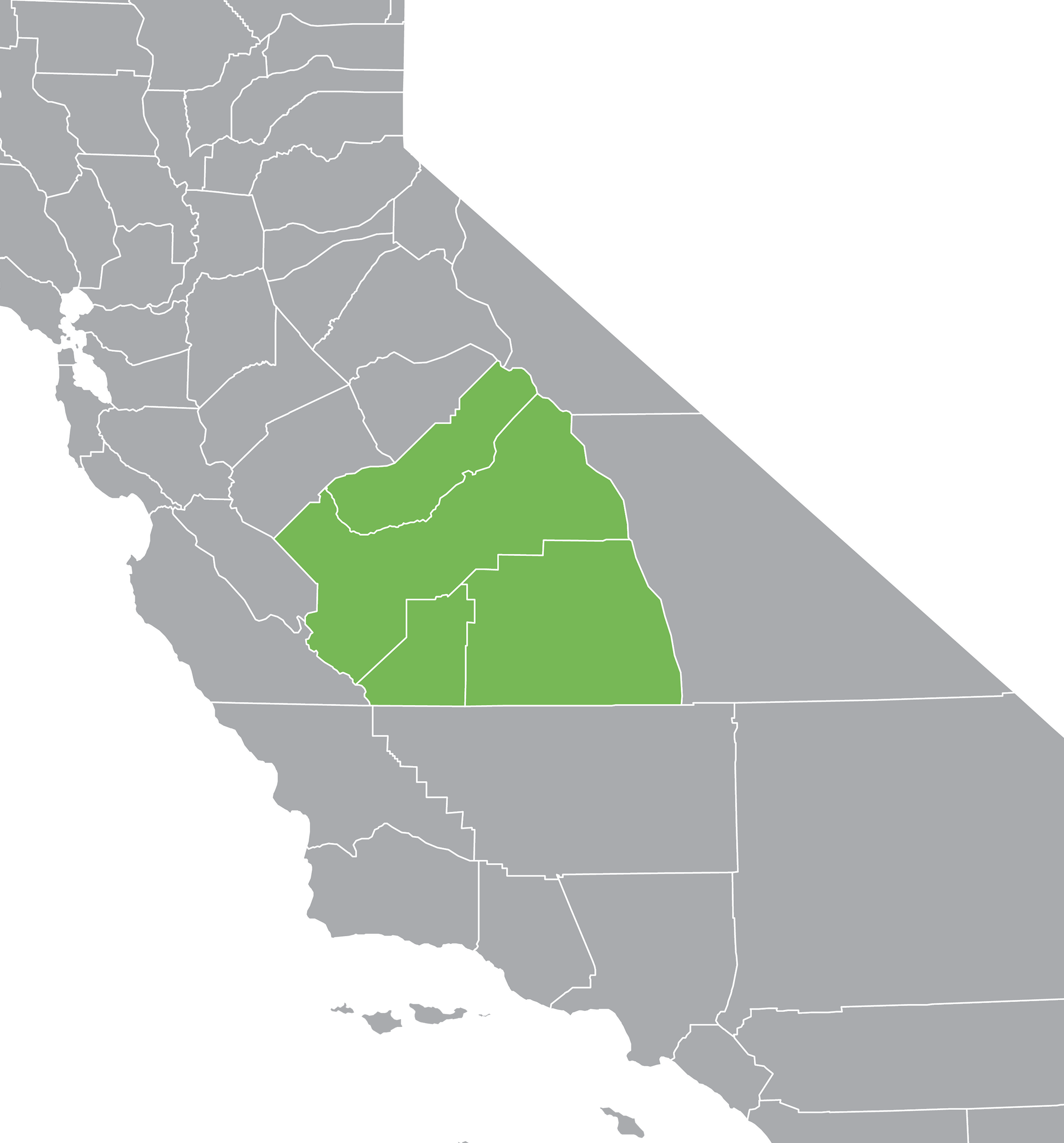

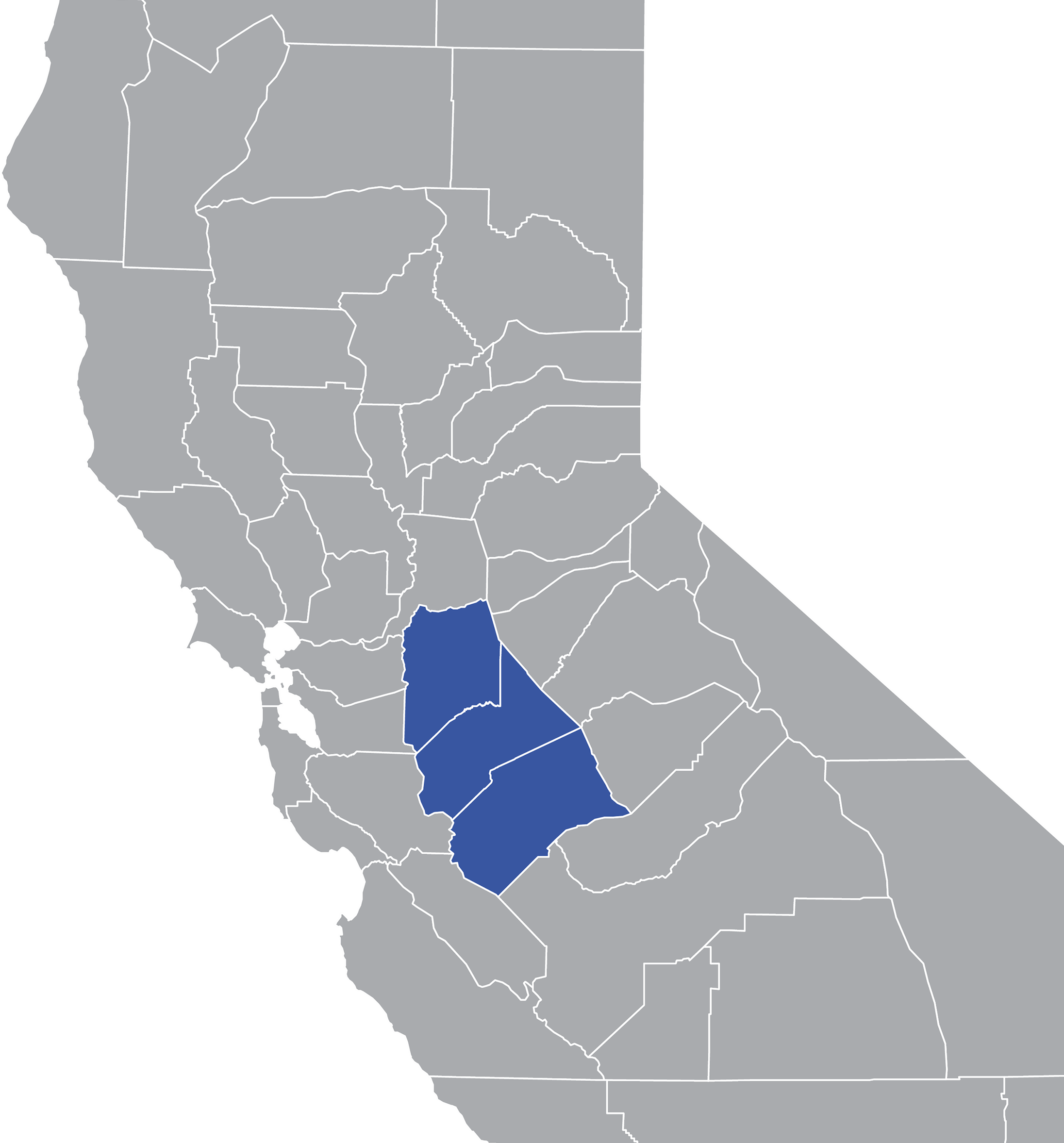

Webthe median property tax in san joaquin county, california is $2,340 per year for a home worth the median value of $318,600. San joaquin county collects, on average, 0. 73% of. Our mission is to ensure the safekeeping of public funds while. Webexplore the charts below for quick facts on san joaquin county effective tax rates, median real estate taxes paid, home values, income levels and homeownership rates, and. Weblearn all about san joaquin real estate tax. Whether you are already a resident or just considering moving to san joaquin to live or invest in real estate, estimate local. Webthe median property tax (also known as real estate tax) in san joaquin county is $2,340. 00 per year, based on a median home value of $318,600. 00 and a median effective. Weboverseeing the property tax billing and collection process for secured and unsecured property taxes levied by california state law, we assist the public in understanding their. Quickly find treasurer & tax collector phone number, directions & services (stockton, ca).

Related Posts

Recent Post

- Weather In The Month Of March

- Copart Self Kiosk

- East Texas Craigslist Farm And Garden

- Nd Craigslist Jobs

- Colbert Late Night Youtube

- Indeed Springfield Mo Jobs

- Skip The Games Toledo

- Craigslist Gigs Jacksonville

- Craigslist Bakersfield Jobs General Labor

- Pay My Big Lots Credit Card

- Pick 4 Nc Day

- Rumble Restored Republic

- Hashtag Basketball Fantasy Rankings

- Listcrawler Detroit

- Craigslist Jobs Los Angeles

Trending Keywords

Recent Search

- Indeed Com San Antonio Tx

- Celebritymoviearchieve

- Sams Club Careers

- Nip Slip On Television

- Join Nearpod

- Hr Block Tax Near Me

- Espn Scoreboards

- Deviantart Esdeath

- Lake Link Fishing Report Wisconsin

- New York Weather Underground

- Iuhealth Portal

- Estate Sales Near Me Today Near Me This Weekend

- Soft Vore Aryion

- Active Warrants Today Joliet Patch Warrants

- Craigslist Miami Jobs General Labor

/state-income-tax-rates-2-2014-tax-foundation-57a631e35f9b58974a3ad3a4.png)