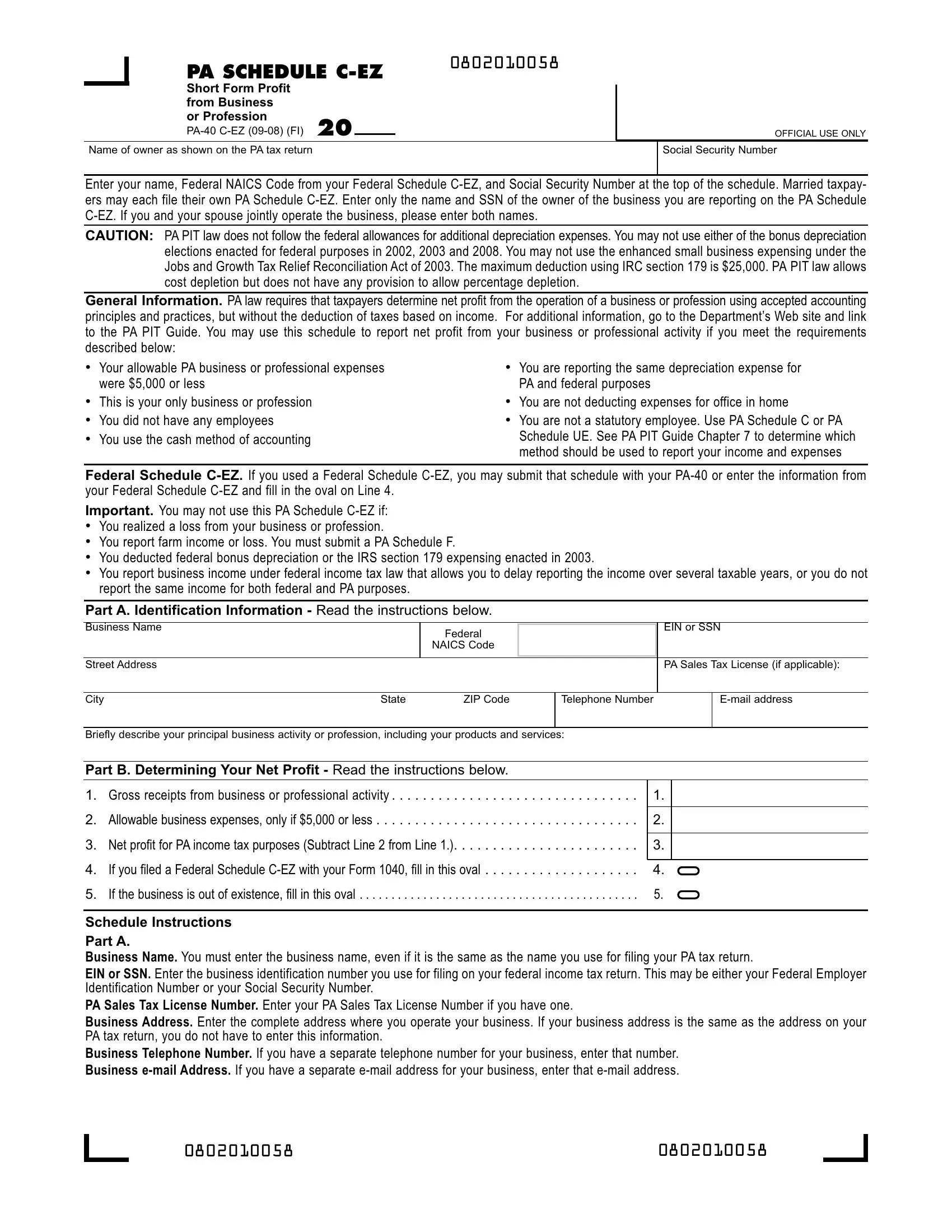

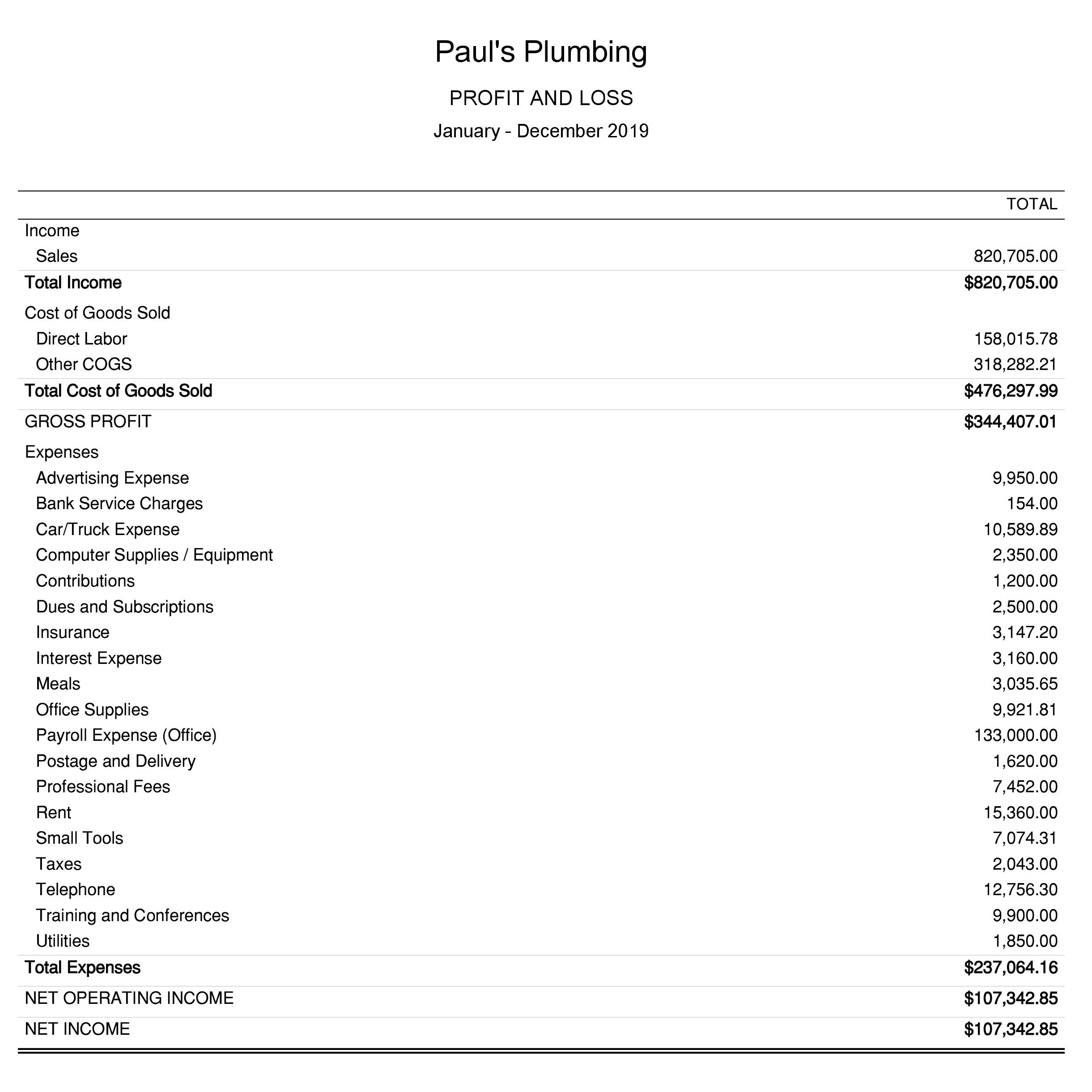

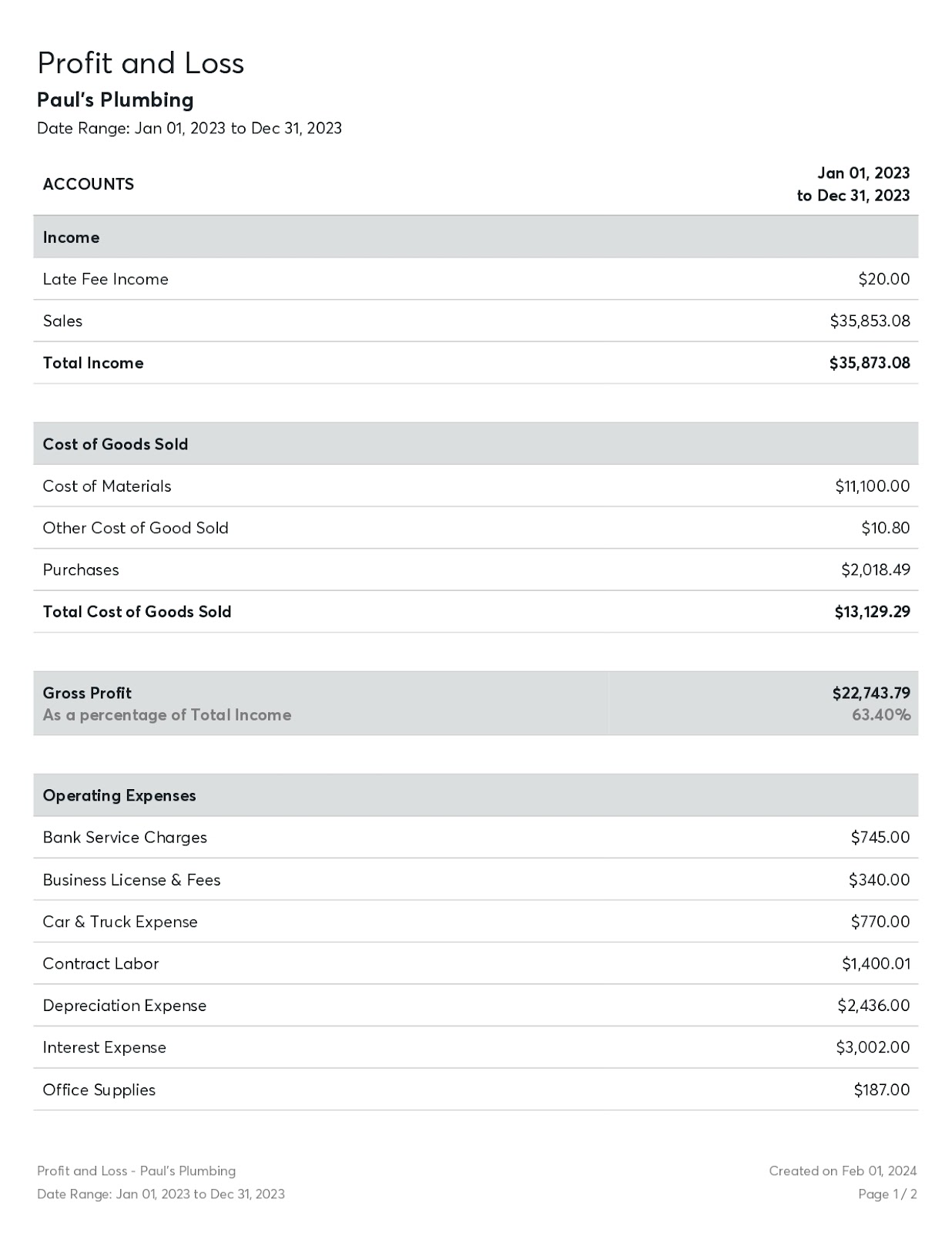

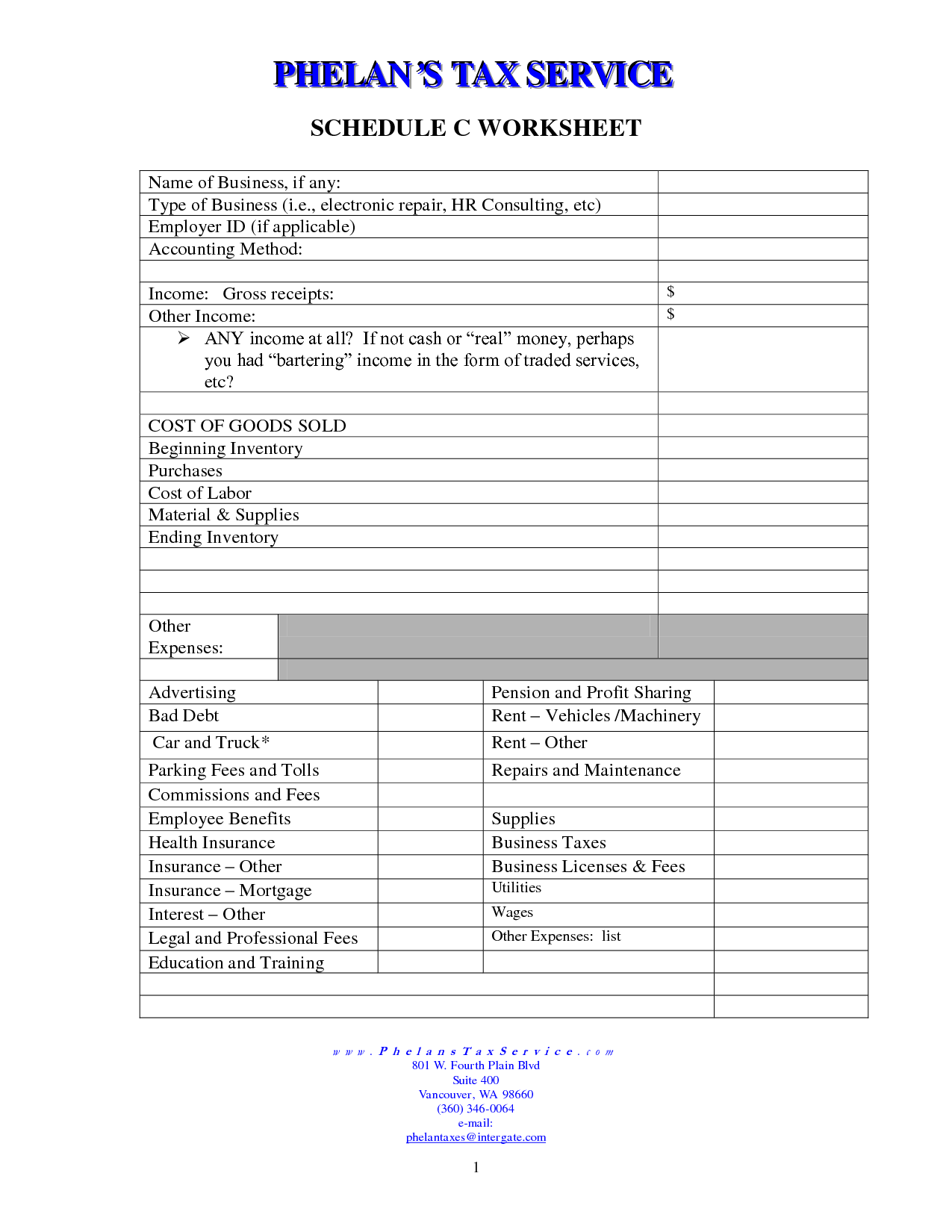

Websep 19, 2022 · schedule c is the linchpin of your independent contractor taxes. It's the form that lets you claim business expenses regardless of whether you itemize your tax. Webfilling out schedule c for your doordash business is a relatively straightforward process. Here are the key sections and questions you need to pay attention to: Webfilling out a schedule c is one of the most effective ways for doordash contractors to pay only what they owe in taxes. Documenting their business income and expenses ensures. If you want to deduct expenses related to your income then you will need. Webuse schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your.

Related Posts

Recent Post

- Jason Lytton Obituary

- Does Zyn Cause Cancer

- Keemstar Child

- Securus Tech

- No Experience Jobs In Boston Ma

- Surveillance Can Be Performed Through Either Stationary

- Victory Outdoor Services Location

- Safety Ati Quizlet

- Wattpad Story

- Michael Schmidt First Wife

- Fails In Bikinis

- Harry Potter Fanfiction Death Eaters Save Harry

- Indeed Jobs Las Vegas Full Time

- Auditorium Theater View From My Seat

- Born February 4 1962

Trending Keywords

Recent Search

- Local Jobs Hiring

- Sean Killinger

- Alex Blumberg Net Worth

- Grace Church John Macarthur

- What Is Funkytown Gore

- 1717 E Grant St Suite 100 Phoenix Az 85034

- Zillow Gulfport Mississippi

- Heather Zumarraga Photos

- Hottest Celebrity Men

- Nexgenesis Maui

- %d8%b3%da%a9%d8%b3 %d8%a7%db%8c%d8%b1%d8%a7%d9%86%db%8c %d8%a8%d8%b2%d8%b1%da%af%d8%b3%d8%a7%d9%84register2 Html

- Rhea County Arrests With Pic

- Ishouldbuyaboat

- Homes For Sale 100k

- Mariposa County Jail Mugshots

/GettyImages-174038203-5a4d1e6de258f80036c28e70.jpg)

:max_bytes(150000):strip_icc()/ScheduleD2022IRS-11353a1e824e41a9a83f83e39fd0f879.jpg)

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)