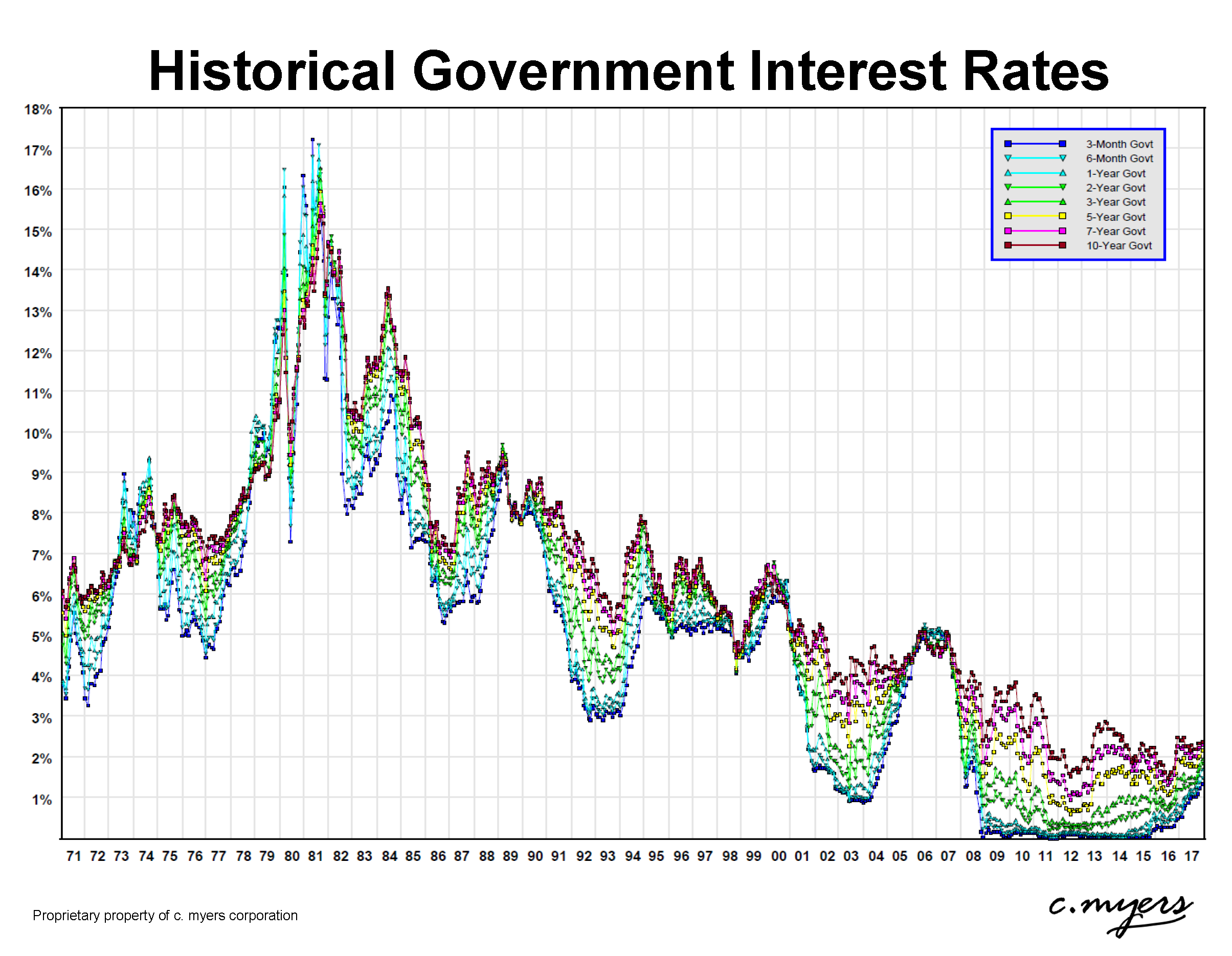

Webjul 29, 2020 · the business interest expense deduction limitation does not apply to certain small businesses whose gross receipts are $26 million or less, electing real property. Webfor taxable years beginning after december 31, 2017, the limitation applies to all taxpayers who have business interest expense, other than certain small businesses that meet the. Websep 1, 2019 · for tax years beginning after 2017, the deduction for business interest expense cannot exceed the sum of the taxpayer's: Floor plan financing interest expense.

Recent Post

- The Poughkeepsie Journal Obits

- Olive Garden Hire Age

- Dark Souls 2 Weapons Tier List

- O Reilly Employee Teamnet Sign In

- Benefits For Working At Gamestoplibrary Detail Html

- General Hospital 61924

- Suoireresnu

- Jewel Food Store Weekly Ads

- Council Bluffs News Todaychat Messenger Html

- Police Blotter Newtown Ct

- Shooting In Lakewood Nj

- Sutter Claravia

- Gina Wilson All Things Algebra 2015

- Cornell Early Decision Acceptance Rate

- Zillow Amarillo 79109

Trending Keywords

- Walmart Cake Catalog

- Hampton Gentry Funeral Home Indianasupport And Help Detail Html

- Briggs And Stratton Engine Governor Adjustment

- High Paying Non Cdl Driving Jobs

- The Poughkeepsie Journal Obits

- Olive Garden Hire Age

- Dark Souls 2 Weapons Tier List

- O Reilly Employee Teamnet Sign In

- Benefits For Working At Gamestoplibrary Detail Html

- General Hospital 61924

Recent Search

- Walmart Conduct What Mean Can Ger Rehire Again

- Mid Length Bob Hair Styles

- Front Porch Selfservice

- Jewel Osco Jobs Pay

- Inmate Inquiry Madera Ca

- The Poughkeepsie Journal Obituaries

- Detective Salaries

- Pawn Shop On Las Vegas Boulevard

- Ups Purchase Boxes

- August Birth Flower Tattoo

- Autozone Sales Manager Salary

- Viking Warrior Tattoos

- Walmart Cake Catalog

- Hampton Gentry Funeral Home Indianasupport And Help Detail Html

- Briggs And Stratton Engine Governor Adjustment

![How To Write A Letter Of Interest In 2021 [Examples + Template] | Steve How To Write A Letter Of Interest In 2021 [Examples + Template] | Steve](https://blog.hubspot.com/hs-fs/hubfs/Sample Letter of Interest Example.png?width=2318&name=Sample Letter of Interest Example.png)